This week I had one of those random chats with an old friend whose job partly deals with payroll management in one of the big corporates.

I casually enquired about how they are coping with implementing the new levies imposed by the government. The response got me by surprise.

With most of the levies targeted at the gross pay, what has been missed out in our public discourse is that most of the target payslips have been committed up to the minimum allowable limit in law.

In 2007, the Employment Act was amended to limit the maximum deductions that can be charged to an employee’s salary to no more than two-thirds of their basic pay.

Section 19(3) makes it criminal for an employer to breach this legal threshold.

The import of this change in law was partly to preserve the dignity of working and partly to save the government from pecuniary embarrassment caused by public officials who borrowed themselves into the negatives of their payslips.

-

.

Keep Reading

-

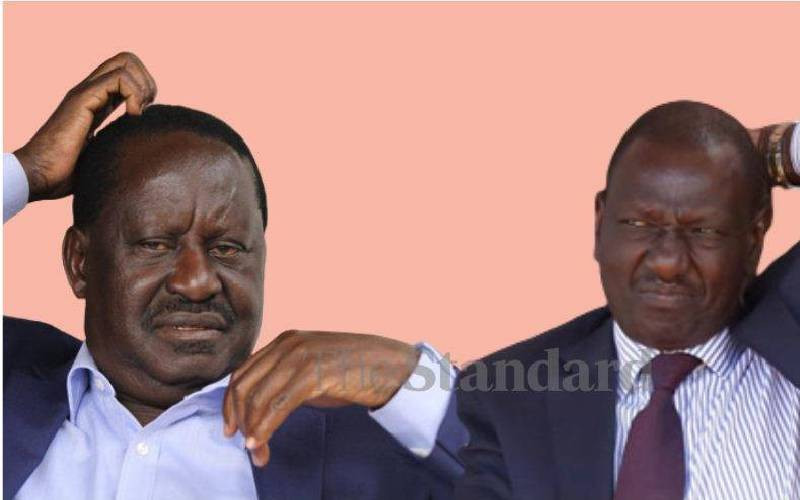

New efforts to bring Raila-Ruto to the negotiation table

-

Ringera got it right, what do we stand for?

-

Reforms team says no to new varsities, wants some closed others merged

-

Don’t be fooled, ongoing protests are about the elite not pro-people

The phenomenon is not only peculiar to civil servants. The media has highlighted cases where leaders borrow excessively, even in lucrative political jobs.

Complex manoeuvre

Living in this country has been reduced to the equivalent of survival in the juggle. It takes complex manoeuvring and resilience to balance the diverse competing interests demanded of any lucky working Kenyan.

It baffles me why the government would spend hundreds of millions of public resources to generate data that it never uses in its policy-making decisions. Take, for instance, the statistics provided in the Economic Survey Report 2023. According to this survey, the average salary for employees in Ministries, Departments and Agencies (MDAs) in 2022 was Sh62,611 per month. Teachers’ average pay for the same period was Sh63,940, Parastatals Sh84,700 and county governments Sh72,541 monthly.

The private sectors of agriculture, accommodation and food services, manufacturing, arts, entertainment and recreation, education, and financial and insurance services paid Sh33,231, Sh39,037, Sh51,469, Sh68,660, Sh87,069 and Sh181,618 respectively per month.

Assuming the average employee has a loan obligation, their payslip will quickly be wiped out to the legal minimum threshold with a single borrowing after the pre-existing statutory deductions.

According to the Absa bank loan repayment calculator, a loan facility of Sh500,000 at 14 per cent reducing interest, spread over a repayment period of 60 months, will require a payslip charge of Sh12,075 per month. Under the same terms, a Sh1 million loan facility will require a charge of Sh24,093 per month.

It is an open secret that the average employee mainly juggles at least two loan facilities at any time: one with their Sacco and the other with their banker.

Given this kind of pay, this is the only means to do simple development projects in this financial jungle called Kenya. This is how many of us have bought plots and built the houses that the government now purports to want to build for us with the housing levy.

The evidence of the tight household incomes is collaborated by the data on using the highly toxic mobile money-based loan facilities.

According to Safaricom’s chief executive, Peter Ndegwa, on September 28, 2022, Kenyans borrowed Sh316 billion for the preceding six months period on Fuliza.

This translates to an average of Sh1.73 billion daily, a 31 per cent increase from a similar period in the 2021 fiscal year when Sh242 billion was borrowed through the facility.

Further official data on financial inclusion indicates that at least 80 per cent of the adult Kenyan population use mobile money providers’ services.

The average borrower borrows from an average of five lenders, mostly borrowing from one to pay another.

Any pre-existing loan agreement between employees and their lenders confers a legitimate claim on their salaries.

The check-off system implemented through payslip deductions effected by employers is the standard industry practice for collections of non-secured loan products by Saccos and commercial banks.

If it is true that a majority of employed folks operate under the limits imposed by the Employment Act, then how should employers navigate this lacuna should the Finance Bill 2023 go to full implementation as it is?

Besides, the direct assault on employee net take home was surely bound to prick the conscience of most of the middle class, often considered aloof to the day’s political happenings.

Legitimate claim

As witnessed during the public participation window over the Finance Bill, the public discourse was up to speed with every single move by the government. As predicted, the Kenya Kwanza political and bureaucratic elites set themselves up for what now promises to be a long protracted battle in the corridors of justice. A casual walk through social media can tell the nation’s mood, especially for those targeted by these taxes.

Applying the principle of signalling effect in economics, one can speculate that Azimio’s call for civil disobedience resonates with most employed folks. While I abhor the violence, loss of lives and destruction of property witnessed in Wednesday’s protests, the spread of the protests to now parts of Lower Eastern and Central Kenya is not surprising.

Dissecting official data and fundamental active public interactions with ordinary folks easily reveals the gravity of the cost of living out here. It does not require complex scientific diagnostics to see and understand this. Unfortunately and tragically so, like their predecessor administration, the Hustlers seem utterly aloof to the plight of those who propelled them into power.

While it is easy for the government to assign blame to the Azimio political leaders, they forget the natural laws of process and momentum.

It should surprise no one when the weekly protests assume a life of their own and turn into a monster that may soon overwhelm the country’s security apparatus.

A noticeable feature that is emerging is the increasing number of protesters who seem genuinely unafraid of the police and death itself.

In the streets of social media, these protestors are being celebrated as heroes of resistance and civil disobedience. Sooner rather than later, unless the government changes tact, two things will likely happen: one, these acts of violence will eventually slip past the control of Azimio’s leadership itself. Two, it may attract local leadership for mobilisation at the community level, or Azimio gets better from the lessons they pick from each day’s protests.

Such an outcome will become a ghost the government must try to avoid at whatever cost. People with nothing to lose are an extremely dangerous lot.