Is this your first time in Kenya?

Certainly not. I was here in 2005, 2006, and 2010 on the issue of, first, microfinance, and later inclusive finance as well as encouraging experimentation and the emergence of mobile money by Safaricom. In 2006, inclusive finance in Kenya stood at 26 percent and now it’s at 79 percent. This is impressive.

Which stakeholders have you interacted with in this current visit to the country?

I always love touching base with people using financial services. I was in Kisumu on my first day where I interacted with smallholder farmers using digital insurance by insurance tech firm Pula, which has teamed up with ag-tech company Apollo. We also visited ag-tech company Hello Tractor, which offers an innovative digital platform that revolutionises access to agricultural vehicles, primarily benefiting smallholder farmers. Such big potential to help build resilience and boost productivity!

In Nairobi, we visited ZamZam Medical Services, where we met Esther Mutoni, a nurse and entrepreneur, who utilised digital financing to help transform her family residence into a healthcare centre. She faced obstacles securing financing until she partnered with PharmAccess’s Medical Credit Fund (MCF), which offers mobile-based loans eliminating the need for traditional collateral and a fixed repayment term.

Esther pays her loan back with a percentage of the payments she receives from her patients, which can differ from day to day. This tailor-made approach gives her flexibility and improves the quality of healthcare.

I have also had sessions with President William Ruto, Environment Cabinet Secretary Soipan Tuya, Treasury Cabinet Secretary Njuguna Ndung’u, Central Bank of Kenya governor Kamau Thugge, Ministry of Information, Communication & the Digital Economy Cabinet secretary Eliud Owalo, and Equity Group Holdings CEO James Mwangi.

What key issues are you advocating for?

One of the primary issues I’m advocating for is the crossover between financial inclusion and sustainability.

This can be achieved through inclusive green finance for low-income households, small businesses, and other vulnerable groups. It’s basically the usage of financial services and products to build resilience to the negative impacts of climate change.

For millions of Kenyans, droughts and floods have devastated their livelihoods, causing the loss of crops and livestock. To bolster household resilience, we can foster financial inclusion through mechanisms such as insurance and by promoting a stronger savings culture.

Key to this is creating digital financial services, often embedded in other products that can support adaptation and mitigation to the risks of climate change. For instance, enabling access to improved seeds, as I’ve seen here in Kenya, like the drought-resistant rice seeds that don’t require much water. It’s about employing different types of agricultural inputs that may have higher initial costs but ultimately result in significantly improved yields.

How can inclusive green finance be achieved in Kenya?

In our meeting with the Ministry of Environment, we have advised that it’s imperative that inclusive green finance be included as a lens in the sustainability conversations.

In your assessment, what are the major hindrances to Kenya attaining the desired 100 percent financial inclusion?

Kenya has done very well, but the 79 percent rate of access to financial services is not 100 percent. Rural women and the poorest are still left behind. Notably, they have much less access to a phone, much less access to connectivity and the Internet. Affordability is a very big issue for them. And all these have a bearing on their access to financial services. We need to go that last mile by making features and smartphones affordable, as well as having much more affordable data packages and mobile money.

Kenya has a very vibrant fintech industry doing a lot of interesting things. If only we could have the digital public infrastructure here and address the affordability of mobile money, we could do so many more things. Kenya can learn from other countries, but it also has a lot to show from its private sector’s innovation.

How can Kenya build on financial inclusion to boost economic opportunities and positive outcomes?

This can be achieved by one, building a foundation to access the digital economy, two, enhancing climate resilience and three, strengthening financial health and consumer protection. Developing a digital public infrastructure such as digital IDs and interoperable payment platforms opens access to financial services for all, fostering economic empowerment.

Inclusive finance can help more Kenyans adapt to and mitigate climate hazards, thereby becoming more resilient. Promoting responsible finance practices, on the other hand, empowers underserved households, strengthening their financial health.

What major lessons are you drawing from Kenya and taking to the rest of the world?

Kenya is an extraordinary example of how mobile money can mean a lot to economies, and a lot of countries have learned from Kenya.

Kenya has gone so far, but this model is stuck now. And we need a lot more things to be paired. Kenya can learn from other countries, like India, several West African nations, and even Brazil, which have put in place digital public infrastructure to make this innovation much more effective.

The biggest concern for most Kenyans is about privacy of their data. So having this data in one place probably is the one thing they are most worried about.

Yes, but many other countries have been able to do that. There can be an ID system that has the necessary safeguards, and a stakeholder consultation process that includes different actors including NGOs. Hopefully, also have an open-source type of system and not one that is locked in with one vendor. While privacy is extremely important, it is also vital that citizens have access to their own data.

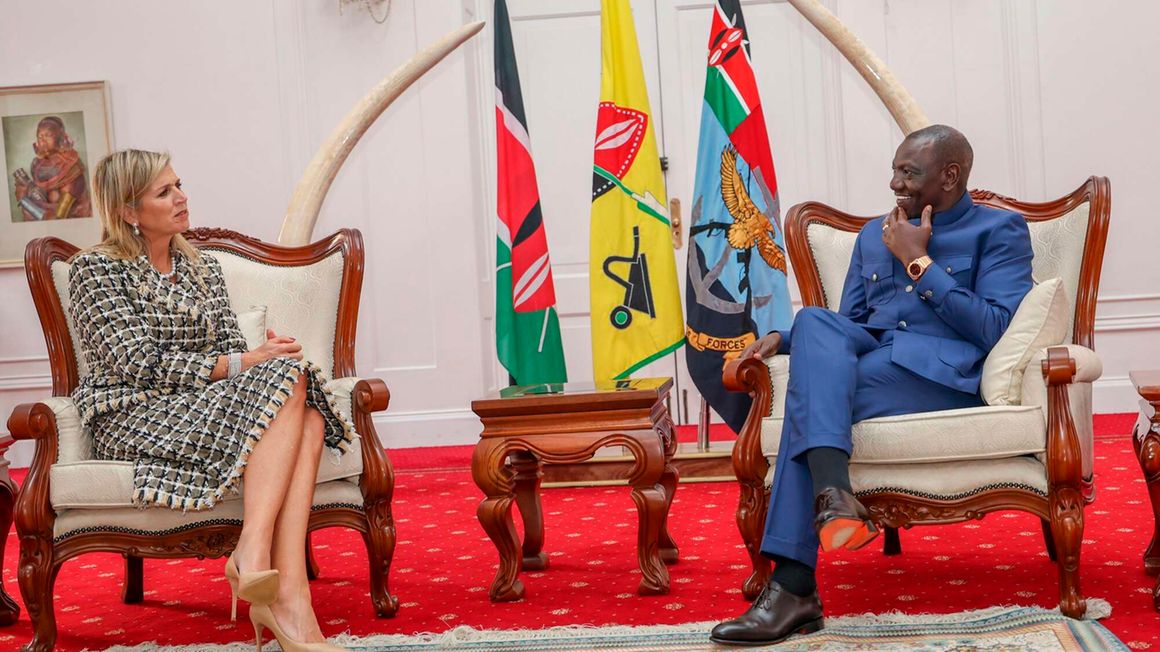

President William Ruto holds talks with Her Majesty Queen Máxima of the Kingdom of the Netherlands at State House, Nairobi. PHOTO | PCS

This is what is going to make a person, no matter their economic background, empowered to get access to many more services that today are not possible for them.

And I agree completely with the privacy issue, but you know, there are ways of covering that. I’ve discussed with the Kenyan government those safeguards and all the experience we’ve had globally.

Stakeholder consultations on this issue are vital because we are cognisant that India is not Kenya, Kenya is not Ghana and Ghana is not Togo. We need to also have a system that is embedded in the culture and practices of a given country.

What are the specific UN initiatives or partnerships aimed at leveraging digital financing to achieve the Sustainable Development Goals, particularly in Kenya and the broad African context?

We do not manage individual projects within my office, but many UN agencies are actively involved in specific initiatives. I would recommend reaching out to them for detailed information on their projects. However, what I focus on are the essential components that enable the success of these initiatives.

A lack of a digital ID can pose significant barriers and limit access to various services. During this tour in Kenya, I have interacted with many partners, including Kenya’s biggest donors, and they depend on having these issues addressed to make their projects work better.

My role is to facilitate coordination and collaboration among key partners working in the field of inclusive finance. I offer advice and support to Kenya to help ensure the seamless execution and implementation of these initiatives.

In your interactions with the stakeholders in Kenya, what are the key takeaways or recommendations you’d like to highlight to promote a more inclusive, digitally empowered financial ecosystem?

We have a situation in which we have near-monopolistic practices, which is making the affordability of these products high. Kenya, right now, internationally, has a high price of mobile money. Asian countries are way lower, Ghana is lower, and Nigeria is lower.

So, there are a lot of things we can do to achieve that. For the prices of data packages and mobile money to come down, we need competition within the mobile money market.

Talk about Kenya’s financial health.

This is critical since financial health has declined in Kenya in recent years, meaning fewer people can manage their daily expenses or unexpected challenges despite improved access.

The 2021 FinAcess Household survey shows only 17 percent of adults in Kenya can adequately manage daily needs compared to 22 percent in 2019.

Financial health is a key goal of financial inclusion. It empowers individuals and businesses in Kenya to manage finances, build resilience, save for the future, and confidently secure their financial well-being.

Promoting responsible financial practices and fostering digital finance innovation, especially for underserved communities, empowers Kenyans. This can be a policy and business imperative.

What can be done to improve this state of affairs?

It’s crucial to shift our focus towards developing financial products that cater to people’s specific needs, ultimately improving their financial health. We can consider the effectiveness of existing overdraft mechanisms for addressing emergency financial needs. Additionally, we can explore ways to integrate insurance solutions into this equation. Finally, it’s vital to promote a culture of savings to better prepare for unexpected financial challenges. By LYNET IGADWAH